FTX is going bankrupt, how this happened and what does it mean for crypto market?

What caused FTXs bankruptcy? This is a question that has...

Read MoreLogin

Register

No products in the cart.

/ by maxime.dibon | Leave a comment

Apple is a company that no one has to introduce anymore: phones, tablets, computers or even connected watches: the American giant is present on all the fields in the new technologies sector. However, for the past few years, it seems to have turned more towards the domain of services. We can mention Apple Music, the platform which competes with Spotify or Deezer, or even Apple TV in the streaming video sector. However, one of these services stands out from the rest: Apple Pay, which has been discreetly integrated into our lives since 2014, and which remains indispensable today. Apple Pay has revolutionized the way we pay: who from generation X still takes their bank card to go out? It is with this successful service that Apple has entered the fintech world. Will Apple stop here ?

Apple’s arrival in the online payment world

As explained above, Apple’s first step in fintech, and not the least, concerns Apple Pay. It is a centralized mobile payment service, allowing you to add and save bank cards directly in the “Wallet” of your iPhone, iPad, Macbook or even AppleWatch. Confidential card information is also encrypted and anonymised to protect the user’s privacy. The service is currently available in 69 countries including France. It works in partnership with the leaders of the credit card industry (Visa, MasterCard and American Express). The introduction of the service was quiet in France, but it quickly became a leading payment method.

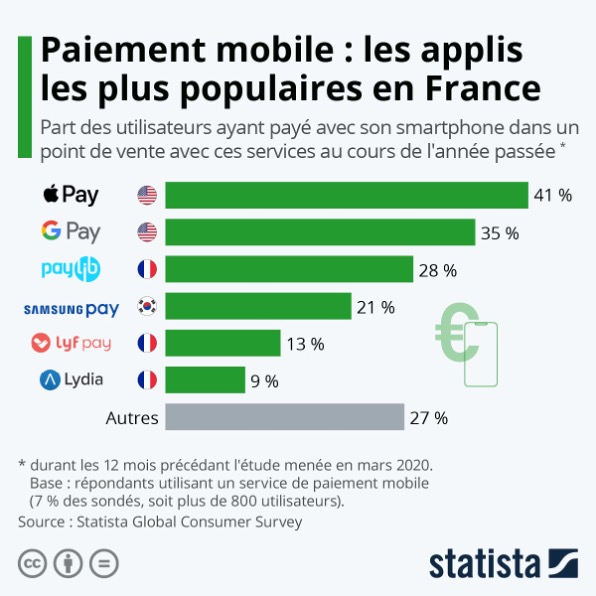

Indeed, it was estimated in 2018 (Juniper research) that Apple’s payment service accounted for 58% of the global contactless payment market share. Apple also dominates its direct competitors, ApplePay is almost 2x more used than GooglePay or SamsungPay so much so that in France, 9% of the population says they have used apple pay at least once in the last year, these figures rising to 31% for Poland, the champion in this area. So, does Apple intend to limit itself here in the banking sector?

The irruption of Apple in the Fintech sector

In August 2019, Apple launched its own bank card in the United States: the Apple Card. It is different from the debit cards we know in France, this is a credit card. To achieve this, Apple has partnered with giants of the American banking sector such as Goldman Sachs and Mastercard to manage the subscriptions. It works like a traditional payment method, but it fits perfectly into the Apple ecosystem and offers services similar to other online banks such as Revolut and Lydia: 0 fees, responsive support and cashback for each completed transaction. Another significant step by Apple in the payment world.

On the other hand, more recently, during the famous annual Keynote by Apple in 2022, the firm has unveiled a new feature – and not the least – for his Apple Pay service: The Apple Pay LATER: a payment facility by 4X without fees and interest, directly with your smartphone for all kinds of payments. At first glance, ApplePay Later seems to be only an additional service, in the continuity of what the firm has been offering for many years, but in this case, something changes: it is Apple itself that will handle all processes related to this new activity. In short, it is the firm from Cupertino that will supervise and process all loan requests from users. For this, a new subsidiary has been created “Apple Financing LLC” which will take care of developing the technologies necessary for the proper functioning of the service and to ensure the follow-up of the requests. With this new company, Apple has chosen to become independent from its banking partners, a project called “Breakout”.

Why such a decision? Apple’s current partners operate mainly in the United States, which limits Apple in the deployment of its international services. As an example, although it exists since 2019, the Apple Card remains available only in the United States. Taking its independence for its services in the banking sector will allow Apple to further assert itself in a competitive market, but in which the company can pull its weight – and it has every interest in doing so – these many services indeed retain users on the Apple ecosystem. At the same time, Apple acquired the British fintech Credit Kudos for $150 million in March 2022, a company developing a credit scoring system, a move closely related to the future deployment of ApplePay later which could help minimize the risks associated with granting bank credit.

Apple seems determined to impose itself in the banking sector, and more precisely in the fintech sector, a market in full upheaval with more and more advanced technologies. It also has an advantage over its competitors, that of the ecosystem, allowing it to implement its new services more efficiently, and also to promote them directly to future users on their Apple devices. The Apple dependency could be even stronger year after year: once the user has integrated the Apple ecosystem, it is difficult to get out of it: the Cloud, AppleMusic, ApplePay and the connectivity between the different Apple devices are a golden prison, in which we seem to love to evolve. In my opinion, the question of online payment and new fintech companies will be a major challenge in the coming future. Physical bank cards seem destined to disappear, and new technology companies have their role to perform in this sector, on the opposite of traditional banks which seem to have difficulties to adapt (the implementation of Apple Pay in all traditional French banks – and international banks – seems to be an avowal of powerlessness against the American giant).

What caused FTXs bankruptcy? This is a question that has...

Read MoreTwitter is a microblogging website and mobile application, where users...

Read MoreThe democratization of information technologies managed to change our personal...

Read MoreReferences: